POV: You just came into $5M in cold, hard USD cash.

Sounds amazing, right?

But then the questions hit:

What do you actually do with it?

How do you move it? Leverage it? Invest it?

Here’s the thing—despite what movies might suggest, you can’t just stroll into a bank with duffel bags of money. They’ll hit you with endless questions, and even getting that much cash through the door is a logistical nightmare.

I know this because it happened to a friend of mine. (A story for another day.)

What I can tell you is this: there’s an entire underground web of money movers—complex networks of changers, couriers, coded communication, and quiet coordination—that exist solely to move capital off the grid.

On the flip side, I’m just as fascinated when I see money being generated at dizzying speeds.

Last week alone:

Bad Bunny’s residency reportedly pulled in $400M in revenue.

New York’s legal cannabis market crossed the $1B mark.

It makes you wonder:

How does money actually move? How does it flow, get tracked, get registered?

Here is the truth: in every industry, the money you see is only half the story. I’ve had a front row seat to this watching cannabis go from illicit/grey to fully legal in multiple countries and countless states.

There is the side with logos, licenses, and LinkedIn profiles…

and the side that hums quietly, efficiently, and very profitably underneath it all.

The illicit market.

Most executives treat it like a taboo footnote.

I see it as an overlooked economic engine — one that quietly shapes consumer behavior, pricing expectations, and even the speed of innovation

Understanding illicit markets is key and discussed well in Jim Rogers Adventure Capitalist and Investment Biker books. In these books, Jim details his travels around the world and his ability to find the underground money changers and make margins on currencies.

His books are written 10 years apart, I highly recommend.

Let’s get into this version of Polaris Perspective.

⌛ Reading time 7 minutes

Was this email forwarded to you? Subscribe here. Also if you’re reading this as a subscriber and know somebody that would enjoy feel free to share. (Referral program down below)

The Invisible Competitor

Whether it’s:

Television (password sharing & IPTV boxes),

Cannabis (legacy cultivators and curbside dealers),

Psychedelics (retreats and underground therapists), or

Currency (informal hawala networks and street FX brokers)

There’s always a parallel market operating in the shadows.

And here’s the paradox: they often move faster than regulated markets.

They don’t wait for licenses, lawyers, or lobbying.

They spot unmet demand and flood it with supply. They set early price anchors. They build customer habits. They even create the first “brand loyalty” before legal brands arrive.

In other words: they sketch the blueprint of the market’s true demand curve — while the regulated side is still arguing about compliance forms.

The Costs We Pretend Don’t Exist

But let’s be clear: this speed comes at a price.

Safety & Security – No quality controls, no traceability, and no consumer protections. A single bad batch can ripple through entire communities.

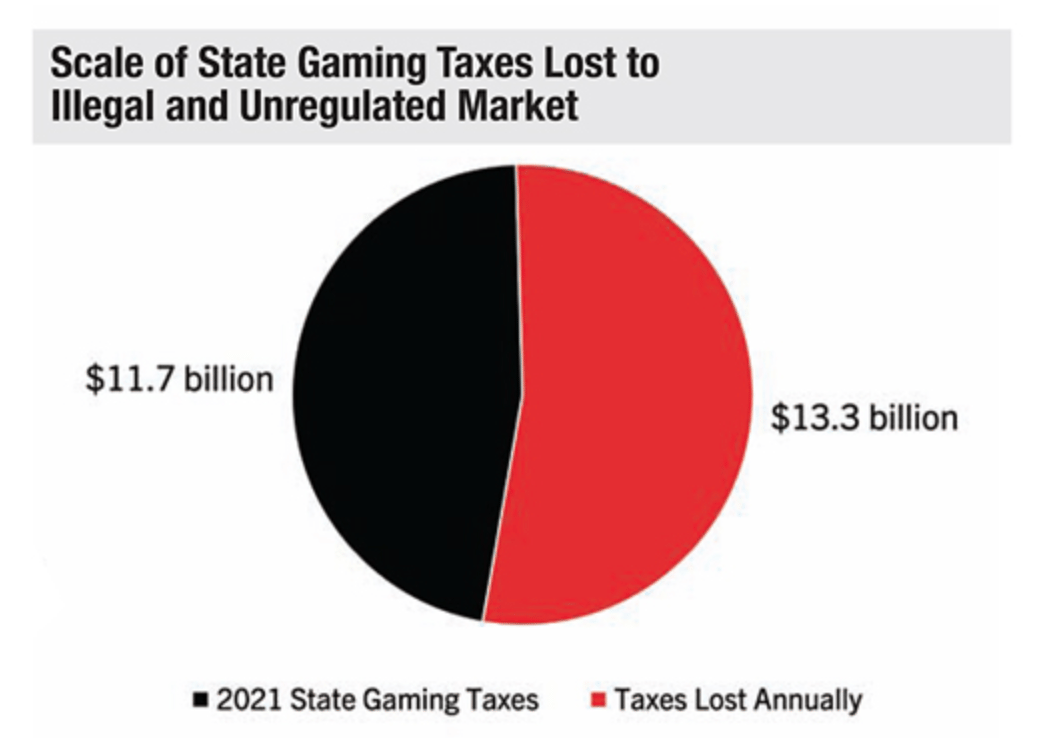

Tax Leakage – Every illicit transaction is a missed opportunity to fund infrastructure, healthcare, and education. Billions vanish off the books.

Innovation Stagnation – Without data, reporting, or research incentives, we lose the compounding effect of institutional R&D. We don’t learn. We just react.

This isn’t just a compliance problem. It’s an economic drag on our ability to compound knowledge and capital.

Source: GGB Magazine

The Polaris Perspective: Study the Shadows

Most leaders make the mistake of ignoring illicit markets until they collide with them.

The best ones?

They study them early — not to romanticize them, but to understand the demand they reveal, the friction they bypass, and the cultural trust they capture.

If you want to win in any market — cannabis, wellness, or fintech — you must build as if an illicit competitor is already out-executing you.

Because they probably are. They are sophisticated, networked, knowledgeable, nimble and have a deep pre-built infrastructure.

A Thought to Leave You With….

Shadow markets are the ghost infrastructure of global commerce: unseen, unregulated, and undeniably influential.

You can’t wish them away, yet you can design around them.

And if you do it well — you don’t just capture market share.

You build safer, smarter, and more sustainable industries.

That’s how real transformation begins.

Not just by winning the market you see, but by out-thinking the one you don’t.

Key Data Points & Comparisons

Cannabis

Size / Forecast of Legal Market

The global legal cannabis market was valued at USD 25.52 billion in 2024, with projections to reach approximately USD 233.33 billion by 2034.

Size / Share of Illicit / Shadow Market

In the U.S., about 75% of cannabis demand (2021) was still being met via illicit sales rather than through the legal supply chain (Politico Pro).

Implications & Lost Value

Legal markets are losing significant shares of potential revenue (tax, regulatory fees, etc.), while illicit producers — with lower compliance costs — continue to undercut prices and shape consumer behavior. The high illicit share also imposes public safety, regulation, health, and enforcement burdens.

IPTV / Media Piracy (TV Subscriptions, etc.)

Size / Forecast of Legal Market

The global legal IPTV market was valued at about USD 68.84 billion in 2023, forecasted to grow to USD 200.22 billion by 2030 (Grand View Research).

Other sources estimate USD 94.07 billion in 2024, growing to USD 296.84 billion by 2033 (Imarc Group).

Size / Share of Illicit / Shadow Market

A pirate-TV ring in Italy was estimated to generate about €3 billion/year in illicit revenue, with damages to content providers estimated at over €10 billion (Financial Times).

In the EU, losses from IPTV-type piracy for sports/TV content have been estimated at around €1.06 billion in some years (El País).

Implications & Lost Value

The shadow market is large enough to threaten investments, distort pricing, and disincentivize legal content creation/licensing. Enforcement and regulation costs mount, while governments lose out on major tax and royalty income. Consumers also face risks from malware, data theft, and fraudulent providers.

Informal Money-Transfer / Value-Transfer Systems (Hawala, IVTS, etc.)

Size / Forecast of Legal Market

Formal remittance systems and regulated financial services are significant and growing globally, but often exclude or are too costly for many cross-border or low-income users.

Size / Share of Illicit / Shadow Market

Informal value transfer systems (IVTS), such as hawala/hundi, are deeply embedded in many regions (Middle East, South Asia, Horn of Africa). They move large sums of money but largely escape formal oversight, regulation, and taxation (IMF, AustLII, Wikipedia).

Implications & Lost Value

These systems create:

Leakage of regulatory control

Reduced anti-money-laundering / counter-terrorism oversight

Lower tax revenue capture

Complications for monetary policy and FX regulation

Because of scarce and fragmented data, research and policy often lag behind actual risks, making it difficult to design effective interventions.

Events You Need to Attend

I’m excited to be part of Hemp for the Future 2025 in Reykjavík, Iceland on October 2–3.

This international gathering brings together experts, innovators, and media from across Europe, the U.S., and as far away as Australia, to explore cannabis, hemp, sustainability, and wellness.

The conference highlights how nature and science meet to create a greener future—join us in Iceland or follow along online!

Media I’m Consuming

Othership Williamsburg – new location just opened!

Lost Man in Bombay (book) – fiction read, reminder to read outside of business

Matthew McConaughey on Rogan

🧘 Longevity

Running on Impact

Longevity takes on a new meaning when you commit to 26.2 miles. I’m officially in for the New York City Marathon, bib secured. With seven weeks to go, the training clock is ticking.

I want to lean on the Polaris community: What recovery strategies should I focus on during training? Reply and share your best advice.

I am also turning this into more than a personal challenge. Over the next seven weeks I will be documenting my journey to race day through training updates, lessons learned, and community insights.

Here is the offering I am putting together for partners:

Sponsorship in the newsletter

Five social posts tied to the journey

Product placement woven into training updates

Race day representation in your gear, colors, and branding at the finish line

If you are a brand that wants to be part of this marathon story, reach out (Reply to this email) to discuss partnership opportunities.

🤖 AI EXECUTIVE CORNER - Not an Ad

If you’ve ever opened PowerPoint, stared at a blank slide, and felt stuck, Gamma might be your new favorite tool.

It takes the friction out of creating presentations, documents, and even landing pages by using AI to generate clean, visual formats in seconds. It’s ridiculous.

A few things we like about it:

Instant polish – presentations that feel designed, without the design work

Interactive features – embed links, videos, or live charts so your deck feels more like a product demo

Shareability – Gamma lives online, so you don’t have to worry about version control or attachments

Time savings – turn an outline into a complete deck in minutes